Monetary Policy vs. Fiscal Policy: An Overview

Monetary policy and fiscal policy are two major tools that governments use to influence the economy. Both policies aim to stabilize the economy and promote economic growth, but they differ in their approaches and objectives.

Monetary policy refers to actions taken by a central bank, such as the Federal Reserve in the United States, to control the money supply and interest rates in the economy.

The primary objective of monetary policy is to maintain price stability by controlling inflation and promoting sustainable economic growth.

The central bank can adjust the money supply by changing the reserve requirements for banks, adjusting interest rates, and engaging in open market operations, which involves buying or selling government bonds.

Fiscal policy, on the other hand, refers to the use of government spending and taxation to influence the economy. Fiscal policy aims to stimulate economic growth, reduce unemployment, and stabilize the economy during times of recession.

Governments can use fiscal policy to increase spending on infrastructure, education, and healthcare or reduce taxes to encourage consumer spending and business investment.

One key difference between monetary policy and fiscal policy is the time frame over which they operate. Monetary policy is generally considered a short-term tool, with changes in interest rates and the money supply having immediate effects on the economy. Fiscal policy, on the other hand, has a longer-term impact and may take time to implement and see results.

Another difference

Another difference is the level of control that each policy has over the economy. Monetary policy is controlled by the central bank and can be implemented quickly and easily. Fiscal policy, on the other hand, requires legislative action and can be more difficult to implement.

Overall, both monetary policy and fiscal policy are important tools that governments use to influence the economy. By carefully managing both policies, governments can promote sustainable economic growth and stability.

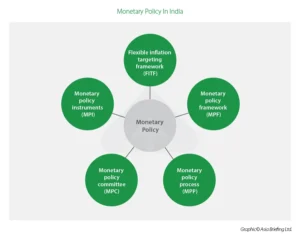

Monetary policy

Monetary policy is the process by which a central bank, such as the Federal Reserve in the United States, manages the supply and demand of money and credit in an economy to achieve its economic objectives. The primary goals of monetary policy are typically to maintain price stability, promote full employment, and stabilize financial markets.

Monetary policy is implemented by adjusting the level of interest rates, the amount of money in circulation, and the availability of credit. For example, if the economy is experiencing high inflation, the central bank might increase interest rates to reduce the amount of money available for borrowing and spending.

This can slow down economic activity and help to reduce inflation. Conversely, if the economy is in a recession, the central bank might decrease interest rates to encourage borrowing and spending, which can stimulate economic growth.

Monetary policy can be a powerful tool for promoting economic stability and growth, but it is not without its limitations. For example, changes in interest rates can take time to have an effect on the economy, and the impact of monetary policy can be unpredictable.

Additionally, monetary policy can be constrained by factors such as political pressures and global economic conditions.

Fiscal policy

Fiscal policy refers to the government’s use of taxation, government spending, and borrowing to influence the economy. The goal of fiscal policy is to stabilize the economy, promote economic growth, and maintain full employment.

The government can use fiscal policy in a number of ways. For example, during an economic recession, the government might increase government spending and cut taxes to stimulate economic activity and increase employment.

Conversely, during a period of inflation or economic overheating, the government might decrease government spending and increase taxes to cool down the economy and prevent inflation.

Fiscal policy is an important tool in macroeconomic management, and it is often used in conjunction with monetary policy to achieve economic stability and growth.

However, the effectiveness of fiscal policy depends on a number of factors, including the political climate, the state of the economy, and the degree of cooperation between the government and other economic actors.

| Home page | click here |

| Micro v/s Macro Economics | Click here |

1 thought on “Monetary policy vs Fiscal policy :”